Add-Backs To EBITDA Can Substantially Increase Business Valuations

I recently represented a buyer looking to purchase land and/or a Winery in Temecula. The Winery under under consideration had no advertised Cap Rate, no Net Operating Income or Sales Price in the advertisement. More so, when I received the Offering Memorandum, the company was in losses (based off of NOI), however with add-backs to EBITDA, they had positive net income. Below is an explanation of why a company may choose to advertise "EBIDTA Add-Back".

EBITDA is an abbreviation for “earnings before interest, taxes, depreciation, and amortization.” It is calculated by taking operating income and adding back to it; interest, depreciation, and amortization expenses. EBITDA is a key metric widely used by financial and investment professionals operating in the lower-middle market to analyze a company’s operating profitability and estimate valuations.

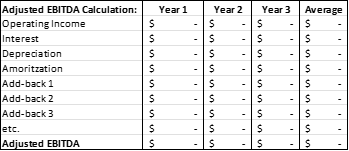

The first step in estimating a market-based valuation is to calculate adjusted EBITDA. This metric is used to “normalize” income and expenses based on what a new buyer should expect.

The recommended approach to calculating adjusted EBITDA starts with operating income and then adds back interest, depreciation, and amortization. Additional add-backs to operating expenses should then be accounted for. The adjusted EBITDA for each year should then be totaled, and a multi-year average calculated.

Common Addbacks to EBITDA:

- Owner Compensation: Many closely held private companies owners compensate themselves with generous salaries, bonuses, and benefits. While nothing is wrong with this approach, an acquirer is unlikely to pay that level of compensation to the new executive. Therefore, the add-back is the difference between the expected go-forward amount and the current amount. Note that the go-forward salary for such a position should be “at arms-length” (no ownership) and represent the amount that would be paid for “like services by like organizations in like circumstances.”

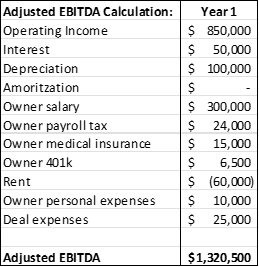

- For example, an owner paid himself a salary of $500,000. If the industry benchmark for such a position is $200,000, $300,000 would be the add-back. But, conversely, if that same owner was paid just $100,000, there would be a negative add-back of $100,000.

- Owner Payroll Taxes and Benefits: In addition to adjusting executive salary, be sure to account for the corresponding change in taxes and benefits. These add-backs can be significant. In the previous example, with a $300,000 salary add-back, there may also be a payroll tax and benefit add-back totaling $45,500. This includes a payroll tax add-back of perhaps $24,000 (8% of salary add-back), a health insurance add-back of $15,000 (5% of salary add-back) and perhaps a 401K max contribution add-back of $6,500 (reduction from $26,000 to $19,500).

- Rent: Many closely held private companies owners separately own the building and charge the business monthly rent. The monthly charge for rent can be significantly above or below the local market price for similar real estate. Buyers will want to pay FMV (Fair Market Value), and sellers are advised to research the local market for competitive pricing and include a positive or negative add-back based on the difference between the go-forward annual rent and the current rent. As an example, let’s assume the seller is charging the business $3/SF below market. A $20,000 SF facility would then have a negative $60,000 add-back.

- Personal Expenses: Running personal expenses through the company is common in closely held companies. Any personal expenses such as those listed below should be identified and subject to an add-back.

- Country club, or other club dues and/or fees

- Owner automobile expenses (monthly payment, insurance, gas, etc.)

- Family members on the payroll that are not working in the business

- Travel, meals, entertainment for personal use, not business related

- Any other expense that is personal in nature and not a business-related expense

- Charitable Donations: Business owners are frequently active community members and sometimes make philanthropic contributions to nonprofit organizations. If a new owner could forgo these gifts without impacting the business, they can be listed as add-backs to impact EBITDA positively.

- One-time Non-recurring Business Expenses: Each of the expenses listed below should be examined individually to validate they are rare and truly a one-time occurrence. If so, they qualify for add-backs.

- Legal fees

- One-time bonus

- Discontinued operations

- Failed initiative

- Bad hires

- Professional costs associated with selling the business (Accounting, Advisor, Legal)

- Rare severance settlements

Addbacks That Are Typically Not Supported By The Buyer:

- Employee Bonuses and/or Significant Retirement Plan Contributions: If such payments/contributions have been paid long-term, the buyer will not want to reduce such benefits and risk employee turnover. Instead, the buyer is more likely to continue such benefits for a period of time and perhaps modify or replace such benefits with alternative benefits in the future.

- Good Rule of Thumb: If the company will incur the identified add-back expenses post-acquisition they are likely not legitimate add-back expenses.

Putting It All Together and Examining the Impact on Valuation:

Market-based business valuations are frequently calculated as a historical multiple of EBITDA. We have pointed out that the EBITDA should be adjusted and “normalized” to reflect what a new buyer should expect to see post-closing. The most common add-backs to EBITDA include owner compensation and benefits, rent, personal expenses, charitable donations, and true on-time business expenses. We have also noted that add-backs can be positive or negative.

In the example on the right, EBITDA totaled $1M. Therefore, if the industry multiple for such a business were 5x, the estimated market-based valuation would be $5M.

Note, however, that the adjusted EBITDA for this business totaled $1,320,500. Using the industry multiple of 5x, the same business would be valued at approximately $6.6m.

Bottom Line

The value of your business should be based on a historical multiple of adjusted EBITDA that is normalized to reflect what a new owner would expect to see. Additionally, a seller may choose to identify a large number of add-backs. Note that buyers will review any and all add-backs with careful scrutiny, and we therefore recommend limiting the list to “significant items.” Lastly, a recommended best practice to ensure maximum valuation for your business is to engage the services of an M&A professional to identify, validate and quantify all add-backs and do so before bringing your business to market.